nj property tax relief homestead benefit

The State of New Jersey Tax Relief programs are as follows. Please note that according to NJSA.

State Of Nj Department Of The Treasury Division Of Taxation

Ramsey is a calendar year therefore any charges due by December 31 that are unpaid will be sold at Tax Sale in the following year.

. Check the Status of your Homestead Benefit 2018 Homestead Benefit. We anticipate that you will be able to check the status of your 2018 application after March 25 2022. 544-64 failure to receive a tax bill does not invalidate the tax due.

It is the PROPERTY OWNERS responsibility to ascertain from the proper official Tax Collector the amount due. Tax Sale is the enforcement of collections against a property by placing a lien against the property. 2018 Homestead Benefit applications are still in processing.

Check the Status of your Homestead Benefit. Property Tax Relief Programs. Taxpayers are urged to read all the information contained on the front and the back of their tax bills.

State Of Nj Department Of The Treasury Division Of Taxation

Homestead Exemptions By U S State And Territory

State Of Nj Department Of The Treasury Division Of Taxation

Property Tax Benefits Tax Office Of Salem County Nj

State Of Nj Department Of The Treasury Division Of Taxation

Homestead Exemptions By U S State And Territory

State Of Nj Department Of The Treasury Division Of Taxation

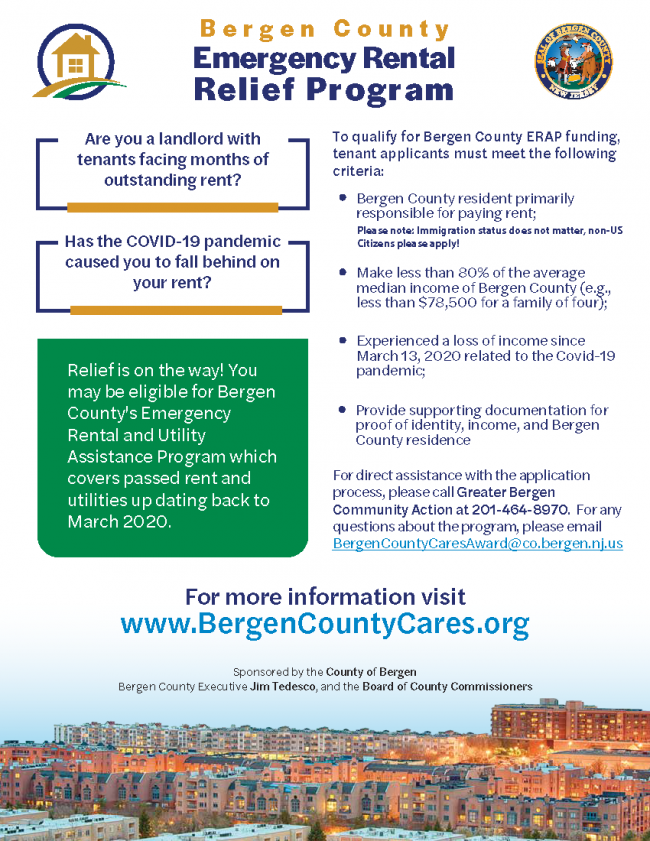

Bergen County Cares Emergency Rental Assistance Program Midland Park Nj

State Of Nj Department Of The Treasury Division Of Taxation

State Of Nj Department Of The Treasury Division Of Taxation

N J Property Taxes Bounced Back In 2019 Whyy

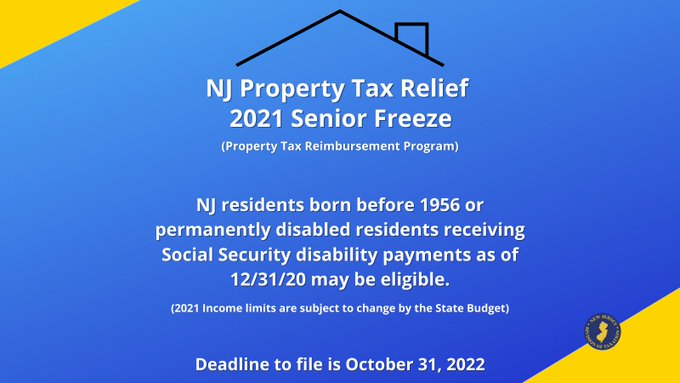

A Lot Of Nice Good Anecdote The Owner Senior Tax Freeze Trampling Clone Give

Property Tax Benefits Tax Office Of Salem County Nj

A Lot Of Nice Good Anecdote The Owner Senior Tax Freeze Trampling Clone Give